Wedding rings for men have transcended from mere symbols of commitment to fashion statements reflecting personal style and identity. In...

When it comes to choosing the perfect piece of jewelry, nothing quite compares to the elegance and sophistication of 18ct...

When it comes to choosing the perfect lab grown diamond ring, every detail matters, including the claws that hold the...

When seeking medical treatment, we place a significant amount of trust in healthcare professionals to provide safe and effective care....

क्या आज दूधसागर में बारिश होगी आपदाओं का आगमन अक्सर हमारे जीवन में अज्ञातता के साथ होता है, और इसका...

Eğitim, toplumun temel taşlarından biridir ve çocukların bilgi, beceri ve değerlerle donatıldığı yer olan okullar, her yıl belirli bir takvime...

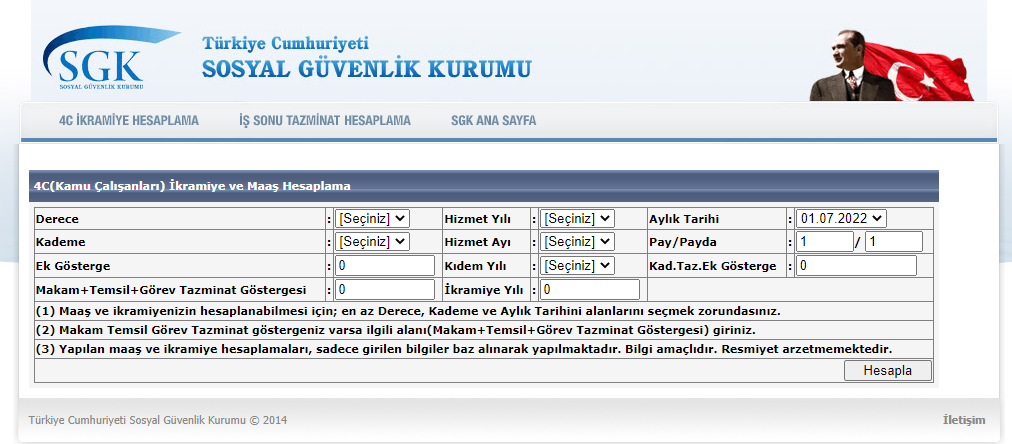

Emeklilik, çalışma hayatının sonunda birçok insanın beklediği ve planladığı bir dönemdir. Ancak ne zaman emekli olurum belirlemek için dikkate almanız...

Hayatın belirli bir döneminde her çalışan, emekli olma fikrini düşünür. Emeklilik, çalışma hayatının sonunda hak edilen bir dinlenme dönemi olarak...

Türkiye'de emeklilik, çalışan bireylerin hayatlarının bir döneminde merak ettiği ve planlamak istediği önemli bir konudur. Emeklilik emekli olsam ne kadar...

Kurban Bayramı, İslam dünyasının en önemli dini bayramlarından biridir. Her yıl, İslam takvimi'ne göre düzenlenir ve Müslümanlar için büyük bir...